Your credit score plays a vital role in many aspects of financial life in the UK — from securing a mortgage to applying for a mobile contract. Yet, many people don’t fully understand what it is, how it’s calculated, or how to improve it. This article explains exactly how credit scores work in Britain, why they matter, and what you can do to manage yours effectively.

What Is a Credit Score in the UK?

A credit score is a number that reflects how lenders view your financial behaviour. It helps them assess how likely you are to repay borrowed money on time. In Britain, your credit score is not a single universal number — each credit reference agency (CRA) has its own scoring model. The three main CRAs in the UK are:

- Experian (scores range from 0 to 999)

- Equifax (scores range from 0 to 1,000)

- TransUnion (scores range from 0 to 710)

The higher your score, the more creditworthy you’re seen as — making you more likely to be approved for loans, credit cards, and rental agreements, often at better rates.

What Affects Your Credit Score?

Your credit score is based on your credit report, which contains details of your financial history. Factors that influence your score include:

- Payment history – missed or late payments can lower your score

- Credit utilisation – how much of your available credit you’re using

- Length of credit history – older accounts can boost your score

- Types of credit – having a mix of credit (cards, loans, mortgage) can help

- Recent credit applications – too many in a short time may lower your score

- Public records – County Court Judgements (CCJs), bankruptcies or IVAs negatively impact your score

Your credit report also contains information such as your name, address, electoral roll status, and whether you’re financially linked to anyone (e.g. a joint account).

Why Your Credit Score Matters

Your credit score plays a key role in whether lenders choose to approve you for various forms of borrowing. This includes credit cards, personal loans, overdrafts, mortgages, car finance, rental agreements, and even mobile phone contracts. A strong credit score can significantly improve your chances of securing credit with better terms — such as lower interest rates, higher borrowing limits, and quicker approvals. It may also lead to more competitive insurance premiums. On the other hand, a poor score could result in declined applications, higher costs of borrowing, or the need to provide a guarantor.

How to Check Your Credit Score in the UK

You can access your credit score for free using the following services:

- Experian – free access through their website

- ClearScore – provides Equifax-based scores and reports

- Credit Karma – powered by TransUnion data

- MoneySuperMarket Credit Monitor – links to TransUnion data

It’s a good habit to check your credit report at least every few months to monitor accuracy and detect any signs of fraud or errors.

How to Improve Your Credit Score

If your score isn’t where you’d like it to be, there are steps you can take:

1. Register on the Electoral Roll

Being listed on the electoral register at your current address helps confirm your identity and stability to lenders.

2. Make All Payments on Time

Consistently paying bills, credit cards, and loans by the due date is one of the biggest factors in maintaining a healthy score.

3. Keep Credit Utilisation Low

Aim to use less than 30% of your available credit. For example, if your credit limit is £2,000, try to keep your balance under £600.

4. Limit New Credit Applications

Multiple credit checks in a short time can make you look financially unstable. Apply only when necessary.

5. Keep Old Accounts Open

Length of credit history matters. Closing older accounts can reduce your average account age, which may slightly impact your score.

6. Correct Any Errors

If you spot incorrect information on your report, you have the right to dispute it directly with the credit agency.

7. Consider a Credit Builder Card

Some banks offer cards aimed at people with limited or poor credit history. Using one responsibly can help build your score over time.

Common Credit Score Myths in the UK

It’s easy to fall for misinformation, so let’s clarify a few points:

- There is no universal credit score – each lender makes its own decision using its own criteria.

- Checking your score won’t lower it – soft searches don’t impact your score.

- Income doesn’t appear on your credit report – though lenders will consider it separately.

- Joint accounts create financial links – your partner’s credit behaviour can affect your ability to get credit.

What Lenders Actually See

While you might see a neat score when using ClearScore or Experian, lenders look at your entire credit report — including payment patterns, credit mix, recent activity and stability. Some lenders also factor in their own internal data, such as past accounts held with them.

Final Advice: Take Control of Your Financial Reputation

Your credit score is an essential part of your financial toolkit in the UK. Understanding how it works allows you to take action, build a strong financial profile, and access better credit opportunities in the future. Whether you’re planning to apply for a mortgage or just want to improve your financial health, monitoring and managing your credit score is a smart place to start.

What Is Open Banking and How Does It Benefit You?

What Is Open Banking and How Does It Benefit You?  The Best Personal Finance Apps for UK Residents

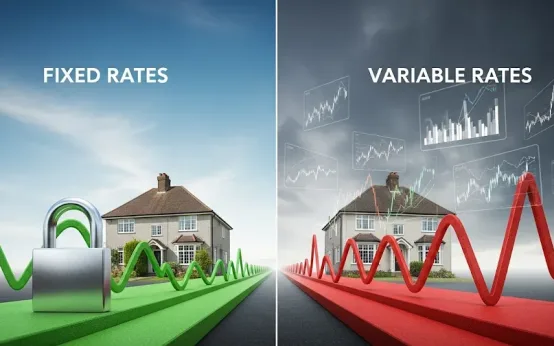

The Best Personal Finance Apps for UK Residents  Should You Choose a Fixed or Variable Mortgage Rate?

Should You Choose a Fixed or Variable Mortgage Rate?