When buying a property in the UK, one of the most important financial decisions you’ll face is whether to opt for a fixed-rate or variable-rate mortgage. With interest rates fluctuating and household budgets under pressure, the type of mortgage you choose can significantly impact your long-term finances. This article explores the key differences between fixed and variable mortgage rates, and how to decide which one suits your situation best in 2025.

What’s the Difference Between Fixed and Variable Rates?

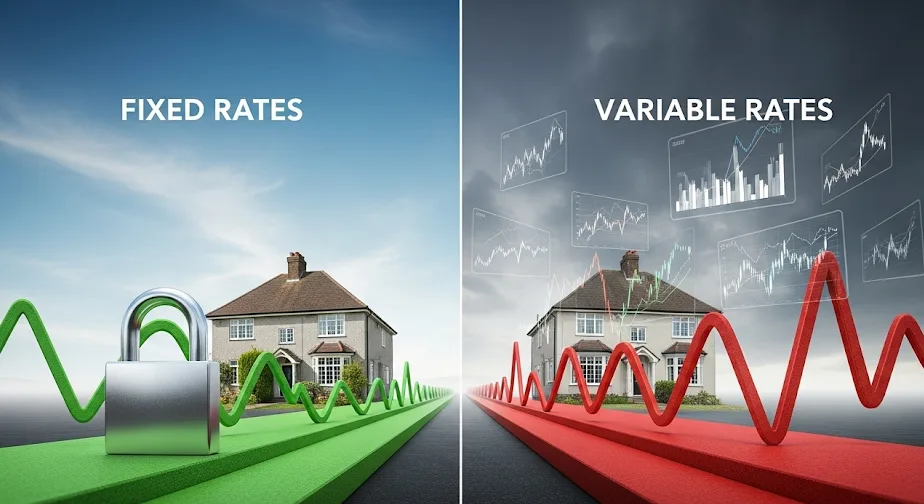

A fixed-rate mortgage offers a set interest rate for a defined period — typically two, five or even ten years. During that time, your monthly repayments remain unchanged, regardless of any changes to the Bank of England base rate or wider market trends.

In contrast, a variable-rate mortgage can change over time. The rate might be linked to the lender’s standard variable rate (SVR), the Bank of England base rate, or follow a specific tracker formula. This means your monthly repayments can go up or down, depending on economic conditions.

Benefits of a Fixed-Rate Mortgage

Stability is the main appeal of fixed-rate mortgages. You know exactly what you’ll be paying each month, which makes it easier to budget — especially useful during periods of inflation or economic uncertainty.

Fixed-rate mortgages also offer protection against interest rate rises. If the Bank of England raises the base rate, your payments remain the same for the duration of the fixed term.

This option is often favoured by:

- First-time buyers who need certainty over monthly costs

- Families working with tight budgets

- Anyone expecting rates to increase in the near future

However, fixed deals may come with slightly higher interest rates than variable options, especially if you lock in for a longer term. And if you want to exit the mortgage early — for instance, to remortgage or move home — early repayment charges (ERCs) can apply, which can be substantial.

Why Consider a Variable Rate?

Variable-rate mortgages tend to start with lower interest rates than their fixed counterparts, especially if rates are expected to fall or remain steady. This makes them attractive to borrowers who want to benefit from lower repayments in the short term.

There are different types of variable mortgages:

- Standard Variable Rate (SVR): Typically higher and controlled by the lender — can change at any time.

- Tracker Mortgages: Follow the Bank of England base rate plus a set percentage.

- Discounted Variable Rate: Offers a discount off the lender’s SVR for a set period.

These products can be suitable for:

- Those who can tolerate some fluctuation in monthly payments

- Borrowers expecting interest rates to fall

- Homeowners planning to move or remortgage soon — as many variable deals come with no or low exit fees

The downside is unpredictability. If interest rates rise significantly, so will your repayments — potentially putting strain on your budget.

How the Rate Environment Affects Your Decision

In 2025, mortgage choices are being made in a climate shaped by recent rate hikes. The Bank of England’s base rate has stabilised after several increases, but uncertainty remains over how long this will last.

If rates are expected to fall, variable mortgages may offer better value — at least in the short term. But if there’s a chance rates could increase again, locking into a fixed-rate now might provide peace of mind and financial security.

It’s important to consider your personal risk tolerance. If rising monthly payments would stretch your finances too thin, a fixed rate may be the safer choice — even if it comes at a slightly higher initial cost.

Other Factors to Consider

Beyond just the rate type, you’ll need to factor in:

- Length of the deal: Fixed terms are commonly offered in 2, 3, 5 or 10-year options. The longer the term, the higher the rate — but also the greater the protection.

- Fees and incentives: Some mortgages offer free valuations, cashback, or lower arrangement fees. Always look at the overall cost, not just the interest rate.

- Flexibility: Variable-rate deals may allow overpayments or early repayment with fewer penalties, which can be helpful if you plan to pay down your mortgage faster.

You should also consider how long you plan to stay in the property. If you expect to move within a couple of years, locking into a long fixed deal might not make sense — particularly if early exit fees apply.

Next Steps: Choosing the Right Fit for You

There’s no one-size-fits-all answer to the fixed versus variable mortgage debate. It depends on your financial stability, long-term plans, and how much risk you’re comfortable taking.

Before deciding, it’s advisable to:

- Use a mortgage calculator to compare different repayment scenarios

- Consult an independent mortgage broker, who can offer personalised advice

- Factor in not just today’s rate, but how changes in interest rates could affect your lifestyle

Ultimately, whether you value certainty or flexibility will guide your choice. Fixed-rate mortgages offer peace of mind, while variable options carry more risk — but potentially more reward.

How Hedge Funds Manipulate the Market: Unveiling Secrets

How Hedge Funds Manipulate the Market: Unveiling Secrets  The Impact of AI on the Gig Economy: Transforming Futures

The Impact of AI on the Gig Economy: Transforming Futures  Will the U.S. Dollar Remain the World’s Reserve Currency?

Will the U.S. Dollar Remain the World’s Reserve Currency?