Open Banking is transforming the way people in the UK manage their money. Since its official launch in 2018, this innovation has gradually reshaped how financial data is shared, accessed and used — not only by banks, but by consumers and fintech apps alike. Yet despite its growing impact, many people still don’t fully understand what Open Banking is or how it can benefit them.

If you’re hearing more about it but aren’t quite sure what it means or how it works, this article will walk you through the basics and explain how it can make your financial life easier, more transparent and potentially more profitable.

Understanding the Basics of Open Banking

At its core, Open Banking is a regulatory framework that allows banks to share your financial data with third-party providers (TPPs) — but only if you give them permission. These TPPs could be budgeting apps, investment platforms, or even lenders, and the goal is to offer better, more personalised financial services.

The system was introduced by the Competition and Markets Authority (CMA) in the UK to encourage innovation and improve customer choice. It requires the nine biggest banks — including Barclays, HSBC, Lloyds, NatWest and Santander — to make their data accessible in a secure, standardised format.

This sharing happens via Application Programming Interfaces (APIs), which enable real-time access to transaction history, balances and account details. It’s not about handing over your passwords — it’s a structured, encrypted, and regulated process.

How It Works in Practice

Imagine you use a personal finance app like Emma or Snoop. When you connect your bank account via Open Banking, the app can securely access your recent transactions and balances. This allows it to provide insights, detect subscriptions, suggest saving opportunities and track spending — all without you having to upload bank statements or manually log in.

Alternatively, if you’re applying for a loan, a lender might use Open Banking to verify your income and affordability instantly, reducing paperwork and speeding up approval.

You remain in control at all times: nothing is shared without your consent, and you can revoke access whenever you choose.

Benefits of Open Banking for Everyday Consumers

Open Banking may sound technical, but the advantages are very practical. Here’s how it can help UK consumers on a day-to-day basis:

1. Smarter Budgeting

With Open Banking, finance apps can categorise your spending automatically and show exactly where your money goes each month. Whether it’s groceries, bills, or takeaways, you’ll gain clearer insights and can set realistic budgets that adjust over time.

2. Better Financial Products

By securely sharing your financial behaviour with lenders, insurers or investment platforms, you may gain access to tailored offers. This could mean lower loan rates, personalised savings accounts or credit cards that better suit your profile.

3. Faster Approvals

When applying for credit or renting a property, Open Banking can replace the need for printed payslips and bank statements. Lenders and letting agents can verify your financial situation in seconds — speeding up decisions and reducing admin.

4. Easier Account Switching

Comparing banks is now simpler. Services can analyse your usage and suggest better current accounts or savings deals, sometimes handling the switch process for you. Open Banking makes account portability much more realistic.

5. Automated Saving Tools

Apps like Plum and Chip use Open Banking data to analyse your spending and automatically move small, affordable amounts into a savings pot — often without you even noticing. These small contributions can grow over time and help build a safety net.

Is Open Banking Safe?

Understandably, many people feel cautious about giving apps access to their financial data. However, Open Banking is built around strict data protection and consent rules. All participating services must be regulated by the Financial Conduct Authority (FCA) and appear on the official Open Banking register.

Your bank credentials are never shared with third parties. Instead, apps receive a secure token that grants limited access for a specific purpose and time. You can monitor and revoke access at any time via your banking app or dashboard.

It’s always wise to check that any app or service using Open Banking is FCA-authorised and transparent about how your data is used.

Common Misconceptions About Open Banking

Although it’s gaining popularity, several myths still surround Open Banking. Let’s clear a few up:

- It’s not the same as screen scraping. Open Banking uses APIs, which are more secure and regulated than scraping your bank login via a third-party site.

- It doesn’t share data without permission. You always have to actively give consent before access is granted.

- It doesn’t put your money at risk. Open Banking only gives read access — it cannot move your money unless you authorise a payment.

- It’s not limited to tech-savvy users. Most apps and banks have made the process simple and intuitive, even for first-time users.

Open Banking in 2025: What’s Next?

In the UK, Open Banking is evolving quickly. There’s growing momentum towards “Open Finance”, which would extend similar data-sharing capabilities to pensions, mortgages, and insurance. This could create even more powerful tools to help people manage their full financial lives in one place.

Banks and fintechs are also working on new payment options using Open Banking — known as Pay by Bank — which may offer faster, cheaper, and safer alternatives to traditional card payments.

As the ecosystem matures, consumers can expect more competition, better pricing, and smarter services that truly reflect their needs.

Final Thought: Take Control with Confidence

Open Banking gives you more power over your own financial data — and when used wisely, it can unlock tools and services that make money management easier and more effective. Whether you’re trying to save more, spend less, or just understand your finances better, Open Banking offers a secure foundation for building better financial habits.

It’s not just for tech experts or investors — it’s for anyone who wants clearer control and smarter choices. The future of finance is open, and it’s already at your fingertips.

The Best Personal Finance Apps for UK Residents

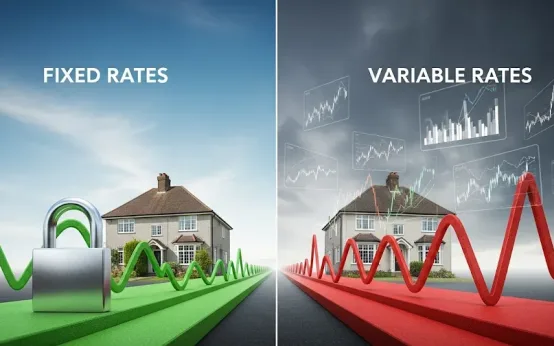

The Best Personal Finance Apps for UK Residents  Should You Choose a Fixed or Variable Mortgage Rate?

Should You Choose a Fixed or Variable Mortgage Rate?  Budgeting Tips for UK Households Amid Inflation

Budgeting Tips for UK Households Amid Inflation