Individual Savings Accounts (ISAs) remain one of the most tax-efficient ways for UK residents to save and invest. Offering tax-free interest, dividends, and capital gains, they are a flexible tool for building wealth, whether your goal is short-term saving, long-term investing, or securing your first home.

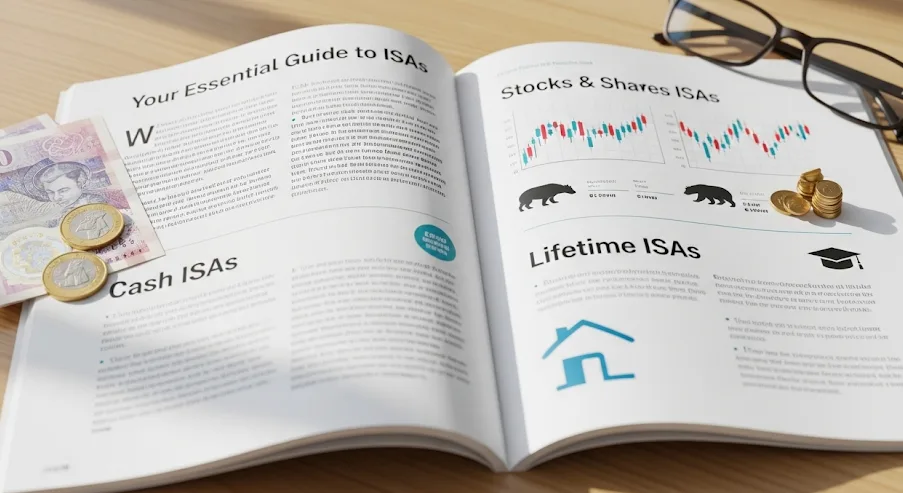

Since the introduction of ISAs in 1999, the range of options has expanded, with Cash ISAs, Stocks and Shares ISAs, and Lifetime ISAs catering to different financial needs. Understanding how each type works is key to maximising their benefits.

Cash ISAs

Cash ISAs operate much like a standard savings account, but the interest earned is tax-free. They are considered low-risk, making them popular among savers who prioritise capital preservation over high returns.

Rates vary between providers, with fixed-term Cash ISAs typically offering higher interest than easy-access versions. However, the trade-off for fixed terms is reduced flexibility in accessing your funds without penalties.

Stocks and Shares ISAs

For those willing to accept greater risk in exchange for potentially higher returns, Stocks and Shares ISAs allow investment in equities, bonds, funds, and other assets. Gains, interest, and dividends are free from UK income and capital gains tax.

While the value of investments can go down as well as up, a well-diversified portfolio can provide significant growth over time. This type of ISA is best suited to long-term investors who can ride out market volatility.

Lifetime ISAs

Lifetime ISAs (LISAs) are designed to help people save for their first home or retirement. Available to individuals aged 18 to 39, they allow annual contributions of up to £4,000, with the government adding a 25% bonus.

Withdrawals are tax-free if used to buy a first home (up to £450,000) or taken after age 60. Early withdrawals for other purposes incur a penalty, making it important to use LISAs strategically.

Key Differences Between ISA Types

Two main distinctions help determine which ISA is right for you:

- Purpose: Cash ISAs suit short-term goals, Stocks and Shares ISAs are better for long-term investing, and LISAs have specific home and retirement advantages.

- Risk tolerance: Cash ISAs carry minimal risk, whereas Stocks and Shares ISAs involve market exposure, and LISAs fall in between, depending on how funds are held.

Maximising ISA Benefits

The UK government sets an annual ISA allowance (£20,000 for the 2024/25 tax year) that can be split between different types. Savers can take advantage of this by combining products — for example, holding both a Cash ISA for emergency savings and a Stocks and Shares ISA for growth.

For investors, strategies such as regular contributions, reinvesting dividends, and diversifying assets can enhance long-term returns while keeping funds sheltered from tax.

Choosing the Right ISA for Your Needs

When selecting an ISA, consider two key factors:

- Your time horizon: Shorter goals may require safer, more liquid accounts, while long-term objectives can benefit from growth-oriented investments.

- Your risk appetite: Conservative savers may prefer Cash ISAs, while those comfortable with market fluctuations might opt for Stocks and Shares ISAs.

Balancing different ISA types can provide both stability and growth in your overall financial plan.

Making the Most of Your ISA Allowance

ISAs remain a cornerstone of personal finance in the UK, offering a tax-efficient way to save and invest. By understanding the differences between Cash, Stocks and Shares, and Lifetime ISAs, and aligning them with your goals, you can make informed decisions that support your financial future.

Impact of the Ukraine-Russia War on Global Markets Today

Impact of the Ukraine-Russia War on Global Markets Today  How the U.S. Debt Ceiling Crisis Impacts Investors

How the U.S. Debt Ceiling Crisis Impacts Investors  BRICS Expansion: Will It Transform Global Trade?

BRICS Expansion: Will It Transform Global Trade?