Inflation continues to stretch household budgets across the UK, making it harder for many families to keep their finances on track. From energy bills to weekly food shops, everyday costs have climbed noticeably — often outpacing wage growth. In this climate, having a clear and realistic household budget isn’t just helpful — it’s essential. This article offers practical, UK-specific strategies to help households manage spending and stay financially resilient despite ongoing price pressures.

Why Budgeting Matters More During Inflation

When prices rise and income remains largely the same, every pound counts. Without a plan in place, it becomes easy to overspend — especially on non-essentials — or to rely on credit to cover routine expenses. Budgeting gives households visibility over their money, helping identify where it’s going, where it could be saved, and how best to prepare for the months ahead.

A good budget acts as a roadmap, helping prioritise what truly matters while reducing financial stress and avoiding unnecessary debt.

Start by Reviewing Your Current Spending

The first step in managing inflation-driven costs is understanding exactly how your money is being spent. Go through your bank statements from the last two or three months. Categorise your spending into essential areas — such as rent or mortgage, utilities, food, transport, and childcare — and non-essential ones like dining out, subscriptions or online shopping.

This will likely highlight patterns and reveal opportunities for trimming expenses without drastically affecting your quality of life. Many UK banks, including Monzo and Starling, now offer in-app budgeting tools that categorise your spending automatically, making this process much easier.

Adjust Your Budget Based on Today’s Real Costs

Inflation affects some areas more than others. For instance, energy bills and groceries have seen sharper increases than mobile contracts or internet packages. Review your existing budget and update the figures to reflect current prices rather than relying on past estimates.

If your energy bill has increased by £30 per month, that needs to be reflected in your monthly planning. Likewise, if council tax or travel costs have changed, your budget should reflect those shifts. Budgeting effectively during inflation means being proactive — not reactive.

Look for Quick Wins That Reduce Monthly Outgoings

While some costs are unavoidable, others can be negotiated or optimised. There may be quicker savings to be made than you expect. For example:

- Switching energy providers if you’re not on a fixed tariff

- Reviewing broadband and insurance policies for better deals

- Cutting unused subscriptions, including streaming services or premium apps

- Planning meals to reduce food waste and impulse grocery buys

- Batch cooking and buying in bulk, especially for staples like rice, pasta and tinned goods

These aren’t drastic lifestyle changes, but they can collectively save a household hundreds of pounds each year.

Include a Buffer for Unexpected Price Hikes

One mistake many households make is budgeting too tightly. With inflation still unpredictable, it’s wise to include a small buffer in your monthly budget — perhaps 5–10% — for unplanned cost increases. This could help absorb the impact of things like a sudden rise in petrol prices or an emergency boiler repair, without derailing your whole financial plan.

Involve the Entire Household

Budgeting is far more effective when everyone in the home is aware of the financial goals and limitations. Whether you live with a partner, children or housemates, having open conversations about spending priorities can help avoid misunderstandings or friction.

For couples, using a shared budgeting app or spreadsheet can be helpful for tracking progress and staying on the same page financially. For families, setting clear guidelines around spending — such as limits on takeaways or monthly treats — helps manage expectations without removing all enjoyment.

Consider Government Support Schemes

Don’t overlook the support that may be available through UK government schemes, especially for households on lower incomes or with children. Options may include:

- Council Tax Reduction

- Warm Home Discount Scheme

- Universal Credit or Child Benefit top-ups

- Free School Meals or transport subsidies

Check with your local council or visit GOV.UK to explore what you might be eligible for. In times of inflation, every bit of support helps cushion the pressure.

Build Savings into Your Budget — Even If It’s a Small Amount

It may seem counterintuitive to talk about saving money during a time when expenses are rising, but even a small emergency buffer can prevent future debt. If you can set aside even £10 to £20 per month, it adds up — and gives you a safety net for unexpected costs. Some digital banks offer “round-up” features, where purchases are rounded up to the nearest pound and the spare change is automatically saved.

Over time, this kind of micro-saving can help you build financial resilience without significantly impacting your current lifestyle.

Stay Flexible, Stay Informed

Budgeting during periods of inflation requires regular adjustment, clear visibility over your spending, and the willingness to make small changes where needed. It’s not about austerity — it’s about smarter decisions, forward planning and staying in control.

The good news is that even modest improvements to your household budget can make a meaningful difference. By staying informed and proactive, UK households can navigate inflation with greater confidence and stability.

What Is Open Banking and How Does It Benefit You?

What Is Open Banking and How Does It Benefit You?  The Best Personal Finance Apps for UK Residents

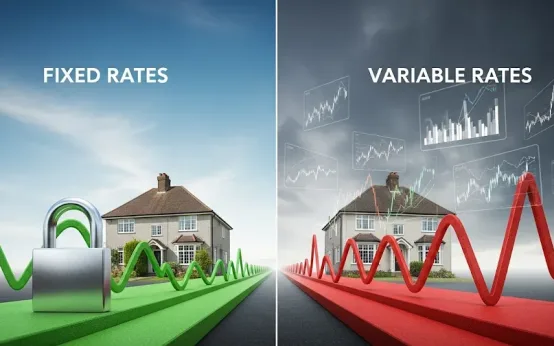

The Best Personal Finance Apps for UK Residents  Should You Choose a Fixed or Variable Mortgage Rate?

Should You Choose a Fixed or Variable Mortgage Rate?