Managing your money effectively has never been more important — or more accessible. With the cost of living rising and interest rates fluctuating, UK residents are increasingly turning to personal finance apps to track their spending, save smarter, and stay on top of financial goals. Whether you’re budgeting for your first flat, trying to clear debt, or saving for a major purchase, there’s likely an app tailored to your needs.

In this article, we explore the top-rated personal finance apps available in the UK, what makes them useful, and how they can help you take better control of your money in 2025 and beyond.

Why Use a Personal Finance App?

Gone are the days of budgeting with spreadsheets or pen and paper. Personal finance apps offer real-time visibility into your income, expenses, and savings — all from your smartphone. Many of them connect directly to your UK bank accounts using Open Banking, which allows secure, permission-based access to your financial data.

These apps help with a range of tasks, from automatic budgeting and subscription tracking to credit score monitoring and saving goals. By automating some of the work, they make money management less daunting and more consistent.

What to Look for in a Good Finance App

Before diving into the top options, it’s worth knowing what features actually matter. A good personal finance app should be easy to use, securely connected to your accounts, and offer clear insights about your money.

Features to consider include:

- Bank integration via Open Banking

- Customisable budgeting categories

- Spending notifications or weekly reports

- Savings goal tracking

- Credit score access

- Bill or subscription reminders

- No hidden fees or intrusive ads

Apps with strong privacy policies, FCA regulation, and good customer reviews tend to offer the most peace of mind.

Top Personal Finance Apps in the UK (2025)

While there are dozens of apps on the market, some stand out for their simplicity, innovation, and UK-specific functionality. Below are some of the best choices for different types of users.

1. Emma – The Budgeting Super App

Emma connects to all your bank accounts and credit cards, giving you a full picture of your finances. It categorises your spending automatically, alerts you to unused subscriptions, and even highlights when you might go into overdraft. The interface is clean and easy to navigate, making it ideal for beginners and experienced users alike.

The free version is powerful enough for most users, but the paid plans unlock deeper insights and customisation.

2. Snoop – Smart Spending Insights

Snoop takes a different approach by offering personalised money-saving suggestions based on your transaction history. It might spot that you’re overpaying for broadband or remind you when a fixed energy deal is about to end.

It’s particularly useful if you want more than just budget tracking — it proactively helps you cut costs. Snoop doesn’t charge a fee and doesn’t sell your data, making it a trustworthy option for value-conscious users.

3. Moneyhub – Holistic Financial Planning

For those with more complex finances — including investments, pensions, or multiple income sources — Moneyhub is a strong contender. It offers a full financial overview, complete with forecasting tools, spending analysis and goal setting.

While it does charge a small subscription fee, it’s well-regarded by financial advisers and FCA-authorised, which adds a layer of credibility.

4. Plum – Automatic Saving & Investing

Plum focuses on building savings without you having to think about it. Once connected to your bank account, it analyses your spending and automatically transfers small amounts into savings pots. You can also set “round-ups” and custom rules to boost your saving rate.

More recently, Plum has added investment options — including ISA and GIA accounts — for those looking to grow their money gradually. It’s great for users who struggle to save consistently.

5. Monzo & Starling – Banks That Act Like Finance Apps

Although technically digital banks, both Monzo and Starling include robust budgeting tools that rival standalone apps. You can track spending in real time, categorise transactions, create “pots” or “spaces” for goals, and receive instant notifications on every transaction.

For many users, using one of these banks eliminates the need for a separate finance app altogether. If you’re looking to simplify your finances, switching to a bank with built-in tools might be the smartest step.

Who Are These Apps Best Suited For?

Each app excels in a different area. Emma and Snoop are excellent for day-to-day spending awareness. Plum shines when it comes to passive saving. Moneyhub is ideal for those who need a comprehensive overview. Meanwhile, Monzo and Starling are best for users who prefer to do everything within one banking ecosystem.

If you’re just starting out with financial apps, Emma or Monzo might be the easiest entry points. If you already have experience with budgeting or multiple accounts, Moneyhub or Plum can offer more depth and automation.

Safety and Security

It’s natural to be cautious when giving financial apps access to your bank data. Fortunately, all apps listed above use Open Banking protocols and are either directly regulated by the Financial Conduct Authority (FCA) or partnered with services that are.

These apps never store your login credentials, and they use encryption to protect your data. Still, it’s wise to read their privacy policies and avoid apps that rely on screen-scraping instead of Open Banking.

Making It Work for You

The real power of personal finance apps comes from consistent use. Checking in weekly, setting realistic savings goals, and acting on insights will give you the best results. Many users report saving hundreds of pounds per year just by tracking their expenses more actively and cutting out unnecessary costs.

Setting up spending limits, automating savings, and receiving alerts before overdrafts or subscription renewals can change your entire relationship with money — often within just a few weeks.

Your Finances, Streamlined

Personal finance apps aren’t just trendy tools — they’re practical solutions for real-world financial challenges. In 2025, they’ve become indispensable for many UK residents trying to take control of their money, whether for budgeting, saving, or future planning.

With so many secure, powerful and user-friendly options available — many of them free — there’s never been a better time to install one and get started. A clearer financial picture might just be a download away.

What Is Open Banking and How Does It Benefit You?

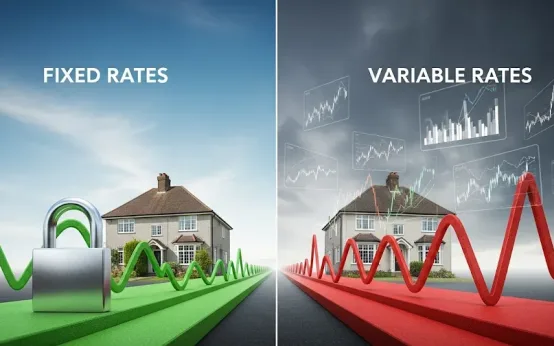

What Is Open Banking and How Does It Benefit You?  Should You Choose a Fixed or Variable Mortgage Rate?

Should You Choose a Fixed or Variable Mortgage Rate?  Budgeting Tips for UK Households Amid Inflation

Budgeting Tips for UK Households Amid Inflation